Is Builder’s Risk for Plumbing Contractors?

February 27, 2020

Is Builder’s Risk Insurance for Painters?

March 14, 2020

Is Builder’s Risk for Plumbing Contractors?

February 27, 2020

Is Builder’s Risk Insurance for Painters?

March 14, 2020The Difference between Builder’s Risk and Inland Marine

For projects currently under construction, the risks and financial ramifications of loss can change as building work or construction project progresses. So, we can say that in some ways, these construction projects are more susceptible to a loss compared to a finished construction project, which is concerning to any project owner. That’s why construction insurance is essential to mitigate the risk of loss.

However, with so many options for insurance policies and coverages, such as builders’ risk insurance and inland marine insurance, it can be hard to know what you need to purchase as a general contractor. Even if you recognize the need for insurance, you may be unclear on the coverage available and who is eligible for each policy. It can even be hard to determine which policies cover tools on site.

With several years of experience in areas like inland marine and builder’s risk insurance and how they secure a construction project, we get these questions all the time. So, let’s get answers to some of these common questions.

For projects currently under construction, the risks and financial ramifications of zloss can change as building work or construction project progresses. So, we can say that in some ways, these construction projects are more susceptible to a loss compared to a finished construction project, which is concerning to any project owner. That’s why construction insurance is essential to mitigate the risk of loss.

However, with so many options for insurance policies and coverages, such as builders risk insurance and inland marine insurance, it can be hard to know what you need to purchase as a general contractor and what you don’t. It can be hard to determine which policies cover tools on site.

While many contractors may recognize the need for builders risk insurance or inland marine coverage, they are unclear on what builders risk policies cover or who is eligible for builder’s risk.

With several years of experience in areas like inland marine and builder’s risk insurance and how they secure a construction project, we get these questions all the time. So, let’s get answers to some of these common questions.

What’s Builder’s Risk Insurance?

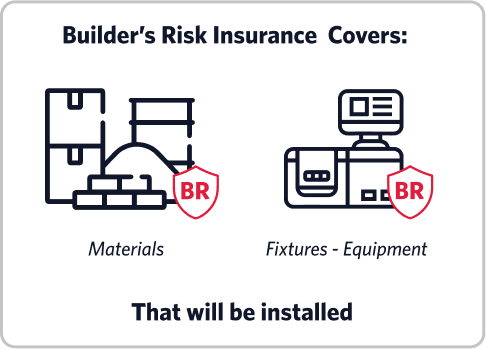

Builder’s risk is also known as course of construction coverage. It protects a contractor or organization’s insurable financial interest in materials, fixtures, or equipment awaiting installation during the renovation or construction of a commercial or residential building or structure. This policy protects a building site from financial losses if these items sustain physical damage or loss from a covered event.

You should know that builder’s risk policy covers the unique needs of property owners, contractors, and construction companies building or adding to warehouses, offices, industrial buildings, roads, retail stores, bridges, schools, and other structures.

However, the differences in covered property or exposures and policy types between builders’ risk insurance providers can make it difficult and tricky to determine what you and your clients can expect from a builder’s risk insurance policy.

What’s Inland Marine Insurance?

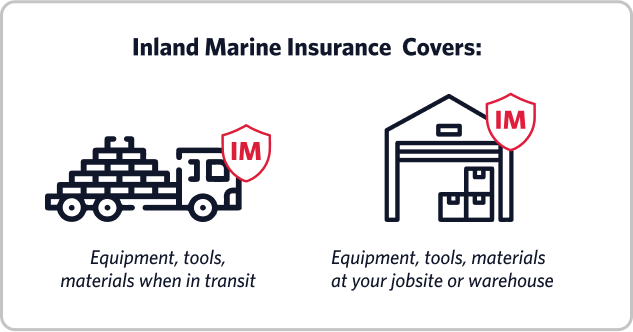

Also known as tools and equipment insurance, inland marine is a valuable policy that provides coverage for materials, products, and equipment when in transit over land or while you temporarily store these items at a job site or warehouse.

An inland marine insurance plan is a vital policy that contractors and construction managers should consider.

You will be happy to know that inland marine coverage is more narrowly customized to a specific purpose than many other forms of insurance coverage. Focusing on protecting contractors’ tools and equipment when they are on a job site or being transported.

Inland marine insurance covers movable assets, tools, and equipment not covered elsewhere, like in auto insurance policies or general liability insurance.

What’s with the Name Inland Marine?

The name inland marine is used because products and materials transported by ship usually were covered under standard ocean marine insurance. However, once these products and materials were transported by train, truck, or bus, a new term was needed, so inland marine insurance was created.

What Exposures Builders Risk Insurance Covers

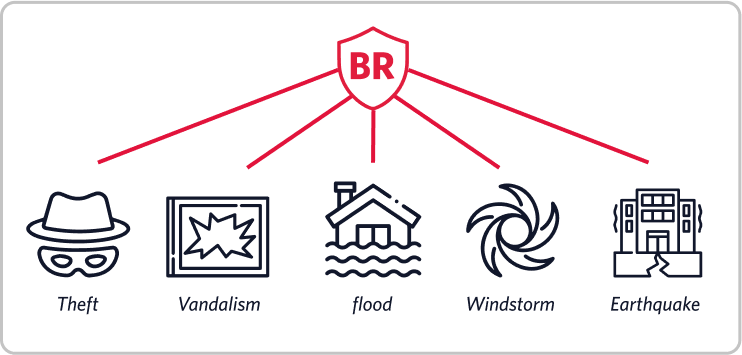

Builders’ risk coverage protects construction sites from financial loss and damage. Although exact builders’ risk coverage and limitations tend to vary between insurance providers, comprehensive builder’s risk policies usually provide coverage for vandalism, theft, and additional coverages, including flood, soft costs, windstorm, and earthquake protection.

What is Covered by Inland Marine Policies?

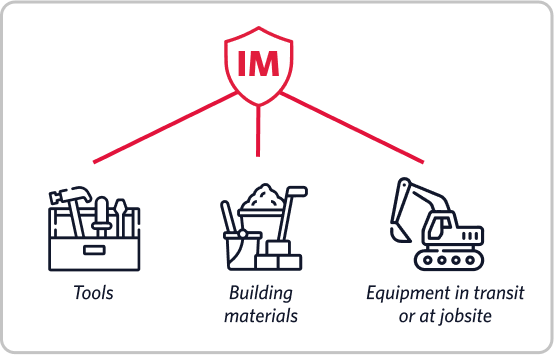

If you are considering getting inland marine, you should consider the specific nature of your business operations to ensure you receive the best property insurance coverage. Inland marine coverage protects your tools, building materials, and equipment in transit or on a specific job site. Do you think your general liability insurance already covers these items?

Remember that general liability only covers losses at the location mentioned on the insurance policy. While it covers property damage and bodily injury claims, these policies will not repair or replace damaged equipment or tools.

What do I need?

Although it was created to protect against losses while shipping goods, remember that inland marine may save your business against many other property damage risks. And some of these risks include the following.

Installation floater

This policy can cover goods from damage or loss once loaded on a truck until they are used.

Bailee’s Customer Coverage

It protects your business from liability if your client’s property is damaged or lost in your care. That can help you if you run a repair shop.

Exhibition and Fine Art Coverage

Fine art coverage can protect if an expensive or valuable piece of artwork, such as a painting, is in transit, on display, or on loan.

You can add additional coverage to include rental equipment, a builder’s risk policy, or an installation floater. However, these added coverages will require extra premium payments.

Inland Marine Coverage VS. Builder’s Risk Insurance

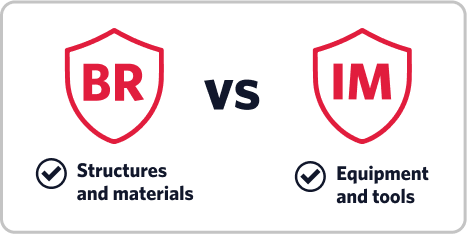

If you are a contractor or run a construction business, you may find it challenging to locate the subtle differences between a builder’s risk policy and inland marine insurance. Also, you should know that many insurance providers advertise builders’ risk as a kind of inland marine policy. They also write builder’s risk policies on inland marine forms instead of commercial property forms, which adds to the confusion.

Know the Difference

An Inland Marine policy is usually written to cover construction tools and equipment, not structures. However, Builder’s Risk needs an extension to cover property in transit, but good news: it can be easily added.

It is safer for contractors and companies to include coverage for building materials.

On the other hand, many types of inland marine policies, such as floater policies, aren’t linked to a specific job site, construction site, or project timeframe. As you can see, these policies offer varying levels of property insurance.

Advantages of Working with an Independent Insurance Agent

If you are considering inland marine insurance or builders’ risk coverage, an insurance agent will help you decide which is right for your business.

Usually, inland marine protection is included in a BOP or insurance package and bundled with other insurance coverages such as general liability, crime, and property insurance. A builder’s risk policy covers the structures and materials used on a construction project. A local broker will simplify things for you, getting you the best rates and coverage from A+ carriers.

Conclusion

If you are unsure about the best coverage against insurance claims, your questions can be answered by experienced insurance agents at Builders Risk.

Related posts