The Ultimate Guide to the Builder’s Risk Insurance Policy

July 6, 2020

Is Builder’s Risk Insurance For Property Damage Claims?

September 28, 2020

The Ultimate Guide to the Builder’s Risk Insurance Policy

July 6, 2020

Is Builder’s Risk Insurance For Property Damage Claims?

September 28, 2020Builders Risk Insurance Protection vs Contractors Liability

Choosing the best insurance coverage to carry between different insurance options has always been debated. This review should help you clarify some of them and understand why both policies discussed here are usually needed for a contractor’s project.

As a general contractor in the construction industry, you need the best insurance policies as coverage when handling construction projects. They prevent possible financial losses and other associated risks when accidents happen at the construction site.

General Liability and Builders Risk Insurance are vital coverages that general contractors must carry. Both policies provide different coverage during a construction project.

The first covers claims for damages from a client or third party, while the other protects your building and equipment during construction. None of these are better than the other; they are helpful for different things.

Is Builders’ Risk Insurance included in a Contractors Liability policy?

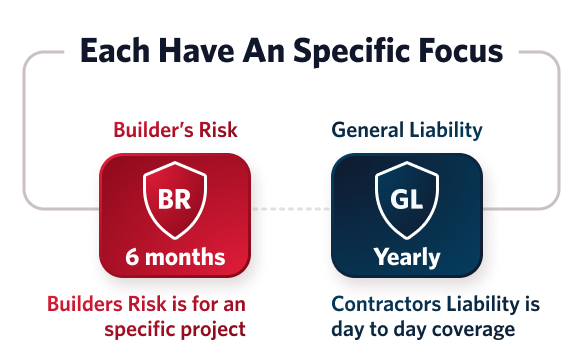

Contractors need to be aware that no single policy will cover them from all the risks they might face in running their business. Each policy has a specific focus. However, an umbrella program like Contractors Liability Insurance, can include various policies to give you more comprehensive coverage.

It is common (and highly recommended) that your Contractors Insurance includes General Liability Insurance. Should it also include Builder’s Risk? The answer is, maybe. Let’s see why.

What is Builders’ Risk Insurance?

Builder’s risk insurance (also known as course of construction insurance) is a vital property insurance policy that protects an organization’s insurable interest, like materials, equipment, etc., from damage and theft. It becomes essential when items sustain physical loss or damage from a covered peril, excluding employee theft.

This type of insurance provides proper coverage and protects every participant (general contractors and independent contractors) on the job site from the project’s inception until it’s completed or handed over to property owners.

Builder’s risk insurance covers financial implications from fire damage, theft, adverse weather conditions, damage to contractor’s tools, etc. It also protects:

- The cost of building materials (including the contractor’s materials)

- The cost of labor

- The cost of permits

- The cost of equipment rental

- The cost of architectural plans

- The cost of site preparation

- The cost of demolition.

- The cost of environmental cleanup

- The cost of debris removal

In addition, it mitigates the loss of profit caused by any of these situations and covers temporary structures like scaffolding and fences. Builder’s risk coverage applies to all construction projects: a new project, major renovations, refurbishment, restructuring, etc. There are different risks associated with constructing and building projects. Carrying the right extended coverage, like the Builder’s risk policy, can cut costs and prevent major financial loss from these risks.

Protection from Weather Events

For any construction site, these can be huge problems. The wind is the most common. In fact, the wind is responsible for 28% of Builder’s Risk claims. Construction site fires are considered an extreme cause of loss because their devastation is so severe. But whatever happens, you need to protect your property.

Builder’s Risk can be triggered without requiring a formal claim if any listed events occur.

Most policies include weather events, arson, theft, and vandalism. But there’s much flexibility, depending on the specific risks of your job. Extensions cover water damage, property in transit, and temporary structures.

And, at only 1-5% of total costs, it makes good business sense.Here’s why: It provides specialized coverage. Some of the properties of Builder’s Risk Insurance are:

- It is property coverage

- 100% of the replacement cost of the building at completion is the value of a policy

- It is term insurance and is generally 3, 6, or 12 months long

- It has a start date and an end date, with other conditions that can mark its cessation

- Also known as Course of Construction Insurance, it covers you for the duration of the construction

- It covers the cost of construction as well as the equipment used

- Tailored for you, it typically covers loss due to fire, theft, vandalism, and weather events

- There are many other loss events you can include if they apply to your project

- This insurance is not mandatory, but many clients will only appoint you if you have it

How Builder’s Risk insurance differs from General Liability

- Builder’s Risk is per-project coverage. The policy covers a specified construction project for the specified period and risks to the project. General Liability coverage is day-to-day protection that goes with you from site to site. You can work on several projects, and you will be covered for them all. So, if any of your clients bring a claim against you for property damage, your General Liability will step in. However, a Builder’s Risk policy is only for the property damaged on a particular project.

- Builder’s Risk provides coverage for the building materials, equipment, and tools used on the covered project. This includes those specified for the project while in temporary storage or transit. Sometimes damage occurs to materials before they get to the site.

- Property damage that is covered by Builder’s Risk is not damage to a third-party’s property. It is coverage for property damaged due to things like:

- Scaffolding

- Vandalism

- Theft

- Fire

- Falsework

- Construction material

What is General Liability Insurance?

Most states legally require this insurance alongside workers’ compensation insurance. The policy provisions cover any accident on the job site, resulting in third-party bodily injuries and property damage. It only covers the policyholder and not everyone involved in the project.

Although an independent contractor can be an additional insured in a general contractor’s business owner’s policy, most insurance experts say most builders should carry their own policy.

Business owners with this policy enjoy coverage from damages, including third-party injury, property damage, advertising injury, etc., excluding external events. It covers the medical payments and legal expenses for lawsuits resulting from bodily or property damage you caused while on the job site. However, the policy includes some coverage exclusions like medical costs or lost wages for an injured employee, intentional damage, illegal activities, errors, omissions, etc.

General Liability Insurance Provides Essential Coverage

Liability coverage is more necessary than ever. You are unlikely to be allowed to set foot on a building site without a General Liability policy. After all, the property owner, developer, or General Contractor does not want to be liable for liability claims that should be in your pocket.

US clients are quick to sue for property damage or injury and there are unending opportunities for liability claims on any construction site. A third-party claim can happen any day of the week. You can take the best safety precautions but can’t stop all accidents.

Digging trenches, re-roofing, or operating heavy vehicles present many chances for accidents. Expect a liability claim if you or your employees cause damage to someone else’s property and also if you cause bodily injury to a site visitor.

This is just a fact of the industry, despite rigorous risk management. The work is dangerous, and slip-ups happen. When there is an error, a General Liability Insurance offsets the losses, so the contractor working on the project does not have to face the bills.

How General Liability Differs From Builder’s Risk

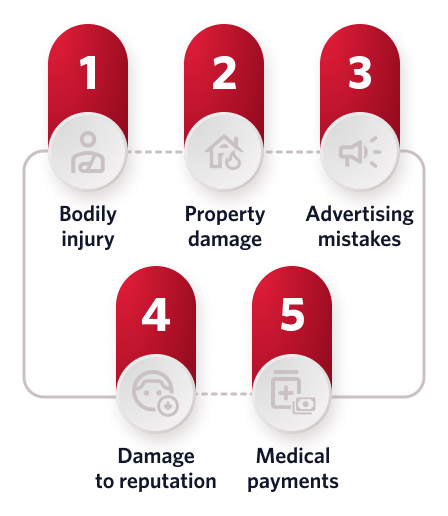

In contrast with Builders Risk coverage, General Liability covers you if sued for negligence that results in damage to another person or causes them bodily injury. It also covers the costs of your legal defense. The damages covered by this insurance coverage are:

- Bodily injury – this is physical injury to another as a result of your actions. This has to do with a client, visitor, or any other person. Should they sustain an injury (fatal or otherwise) as a result of your work or your work site, your business will be held liable.

- Property damage – accidental damage to the property of another in the course of your work. This is damage to a client, visitor, or other person’s stuff. If it results from your or your employee’s actions during the course of work, then your business is liable.

- Advertising mistakes – the damage you cause to another person as a result of your advertising, for example, through copyright infringements

- Damage to reputation – the damage you cause to another person or company, for example, through slander or libel

- Medical payments – medical care costs if an injury to a person at your work premises occurs.

The Pros And Cons Of Builders Risk And General Liability

On the other hand, pros and cons vary significantly between policies. We’ll take a closer look at these below:

Pros of Builder’s Risk Insurance

Like every other property coverage, this policy protects the financial assets of a business during projects. It reduces loss incurred from a covered peril and pays for equipment replacement costs, repair costs, debris removal fees, cleanup costs, etc. It is also not compulsory for everyone involved in the project to carry out this policy. As the general contractor’s policy covers everyone, thereby saving costs.

Cons of Builder’s Risk Insurance

While the policy covers most natural disasters and damage to equipment and property, it doesn’t cover employee theft or bodily damage. It only protects the job site and equipment, not the contractor and other workers involved in the project. Employee injury, third-party injury, or property destruction can also leave huge financial debt on the business. Legal defense and judgment fees, employee medical treatment costs, etc., are some risks the business could still face.

This makes carrying additional insurance like a workers’ compensation policy essential. Also, the coverage has a validity period and stops immediately after the project is completed and handed over to the owners.

Pros of General Liability Policy

This policy is a vital business insurance every contractor must carry, so most states demand it. The policy covers third-party medical expenses due to bodily injury caused while handling a specific job or legal fees incurred from a lawsuit due to property damage. Unlike the Builder’s risk, this policy isn’t specialized, and it remains valid throughout a contractor’s career.

Cons of General Liability Policy

The policy has a lot of limitations. It neither protects the job site and equipment nor the contractors involved in the project. The policy is mainly concerned with the third party. Also, a single policy doesn’t cover everyone involved in the project. Every independent contractor must have this policy coverage protection against possible liability.

Do You Need Both?

Contractors must carry both insurance policies, as Builder’s Risk protects the building and equipment, while the general liability policy protects the contractor and his business. The general liability policy and other additional insurance should provide coverage against possible risks for independent contractors not in charge of the project.

FAQs

There are many advantages to using an independent insurance agent when shopping for builders’ risk protection policies.

- Independent agents have access to multiple insurers, so they can compare rates and coverage options to find the best policy for you and ensure that you end up with the proper coverage.

- Independent agents are not beholden to one insurer, so they can give you unbiased advice and have the contractor’s interest in mind.

- Independent agents can help you navigate the claims process if you need to file a claim.

- Independent agents can offer guidance and advice throughout the construction process. Get an agent today!

Related posts