Homeowners Coverage vs Builder’s Risk Insurance

January 11, 2024

I’m Not the Contractor, Why do I Need a Builder’s Risk Policy?

January 14, 2024

Homeowners Coverage vs Builder’s Risk Insurance

January 11, 2024

I’m Not the Contractor, Why do I Need a Builder’s Risk Policy?

January 14, 2024What does Builder’s Risk Insurance cover?

Builder’s risk insurance policy covers residential and commercial structures under construction or an existing structure undergoing renovation. Construction sites are risk-prone areas for both the buildings and the workers. Thus, insurance coverage is necessary to protect yourself from financial loss and other associated risks.

What is Builder’s Risk Insurance?

The builder’s risk insurance policy (also known as course of construction insurance) is vital in the construction industry. It protects under-construction buildings from likely perils.

Construction projects face constant weather-related and man-made risks, and the builders’ risk policy ensures you don’t have to bear the loss if any of these perils occur.

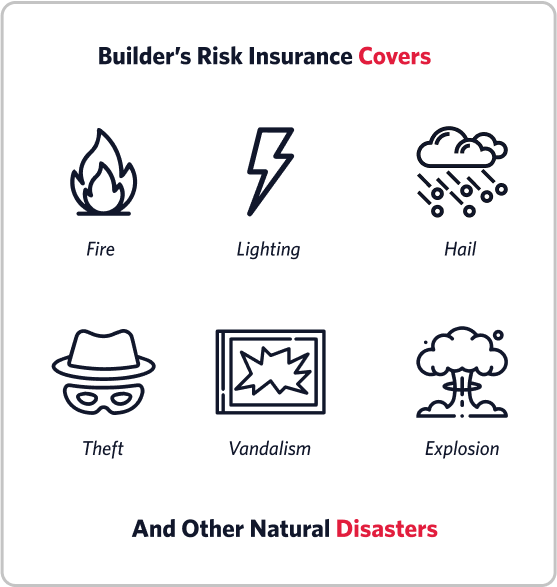

The liability coverage protects your business from fire, lightning, hail, equipment theft, vandalism, explosion, and other natural disasters. However, you may need a coverage extension for additional risks your business may face during construction, which aren’t included in your builders’ risk insurance.

Examples of covered perils are:

Natural Disasters

Natural disasters come in the form of windstorms, hurricanes, lightning, floods, and fires. This type of insurance covers such disasters – although you may have to pay more in premiums based on your geographic location. For instance, coastal areas typically do not cover wind, earthquakes, and floods.

Example: As a general contractor, you’ve started building a two-story building. The foundation is almost complete when a fire destroys it completely. You’ve already spent quite a bit on the foundation, but you must start again.

In this case, your Building Risk Insurance coverage will compensate you. You’ll be sorted not only for the materials used but also for the labor charges spent and the cost of cleaning up the debris.

Theft and Vandalism

There’s a greater risk of theft and vandalism when it comes to construction sites in high-crime areas.

Example: You’ve started construction on a parking site in a high-crime area and are almost nearing completion. One night, thieves enter, vandalize the place and make off with all the equipment on-site. That’s where your Builder’s Risk insurance cover comes in. The worth of the equipment stolen is noted, and the amount reimbursed to you is under your contractor coverage.

Vehicles and Aircraft

Vehicles and aircraft can pose a significant risk to construction sites.

Example: As a general contractor, you oversee all aspects of building a hotel near a small airfield. As the foundation has been laid and the framing started, there is quite a lot of equipment on-site. Suddenly, a plane with engine failure crashes on the site and causes widespread damage.

The cost of labor, materials, equipment destroyed, and debris cleanup charges are reimbursed through Builder’s Risk Insurance. Now, you can start reconstructing.

Who Purchases the Builder’s Risk Insurance?

Ideally, anyone with a financial stake in a construction project can carry Builder’s Risk Insurance. Most times, it’s agreed upon in the construction contract. Project owners, contractors, subcontractors, architects, and engineers are all eligible to carry the course of construction insurance.

Some construction projects usually have many people involved. Thus, the general contractor of such a project would carry the builder’s risk coverage while others are named as additional insured. However, having the property owner as the policyholder is considered the best practice. In this situation, if a covered loss causes damage, the property owner makes a claim and reimburses the contractor for damages.

A waiver of subrogation is a standard inclusion in your Builder’s Risk insurance cover. Through this provision, each contractual party waives the right of their insurance carrier to seek compensation for losses from others on the job.

Builders Risk Coverage Form

Insurance providers do not issue forms for builders’ risk policies. Instead, it appears on a completed value or reporting form. However, the policy is still part of the vital business insurance policies that construction businesses must carry. Below are some of the things the builders’ risk insurance covers:

Buildings under construction

Builder’s risk insurance bears the cost of any covered loss on the job site of either a new construction project or an existing building undergoing significant renovations. It also covers temporary structures like scaffolding and amenities in the protected property.

Equipment

Equipment theft and damage are possible on a construction site. Builder’s risk insurance pays for associated costs if the equipment is under the policy coverage.

Construction materials and supplies

Builder’s Risk Insurance covers all inputs being used on the construction sites. That includes valuable documents like blueprints, schematics, and stored electronic data. You can always leverage the policy if building items sustain a physical loss.

Debris Removal

Covered peril like fire accidents may occur, leaving large debris. The fire department service charges for clearing the waste can be too costly for construction companies, leading to debt without the builders’ risk insurance.

Removing and clearing debris from the building site before any repairs occur can cost tens of thousands of dollars. What’s more, costs can increase depending on the disaster’s scale and building size. Builder’s Risk for General Contractors will pay the price to remove debris from the worksite.

Ordinance and law costs

The builder’s risk insurance pays the increase in the cost of repairing and rebuilding due to laws and building codes when the loss occurs.

Pollutant Cleanups

Contamination is likely after a natural disaster. Furthermore, if this happens, you cannot work on the land until it’s free-from pollutants and decontaminated. A variety of factors cause pollutants, including:

- Chemical Spills.

- Paints.

- Asbestos Insulation.

- Pesticides.

- Lead Batteries.

Moreover, specialized cleanup is required, and that’s very expensive. The last thing you need is to worry about being out of pocket. And while the policy won’t cover major disasters like tornadoes, your Builder’s Risk policy may still cover the related cleanup costs.

The Loss Of Electronic Data Onsite

You rely on schematics and blueprints to do your job. Furthermore, they’re likely stored on the job site; if they’re lost or damaged, the delay can cost your business dearly. For example, a lightning storm strikes and starts a fire on site. All electronic data is lost.

In this instance, you not only have to deal with the impact of the fire but the recovery of blueprints and other documents. Moreover, having Disaster Coverage for General Contractors will cover any loss incurred.

Soft Cost

You can also leverage the insurance policy to cover costs resulting from construction delays. These may include loss of sales income, real estate taxes, rental income, additional interest in loans, etc.

Builder’s risk policy can also cover labor costs; you’ll have to pay separately for adding extra coverage.

Coverage Exclusions

Builder’s risk insurance does not cover certain things and events unless customized. They include:

- Completed Building: Coverage ends once a building is completed and handed over to the owner. However, the building owner can purchase general property insurance to be protected from future damage. Completed buildings aren’t under the policy coverage.

- Earthquake and flood: These events are not covered as perils in some locations. You can purchase separate coverage for any of the two.

- Third-party claims: The builder’s risk policy covers legal fees or medical bills resulting from any damage or injuries you or your employees caused during a project. You’ll need general liability insurance for this coverage option.

- Poor Workmanship/Professional Mistakes: Design defects or mistakes due to negligence are excluded from the coverage. You need professional liability coverage for any claim from such an event.

- Equipment Breakdown: Apart from damages from covered peril or construction site theft, Builder’s Risk won’t cover this event. You need additional coverage in such cases.

- Employee Theft: This is also excluded from the policy coverage. It only covers on-site theft by a person (or group of people) other than your employees.

When does Builder’s Risk Insurance coverage end?

Unlike other types of insurance, Builders Risk insurance can have a complicated end date. We’re here to help.

If you have previous experience with purchasing insurance policies, then you understand that most policies have a clear beginning and a clear end. Insurance companies typically call these effective and expiration dates.

However, if you’re new to the world of construction insurance, then you might not understand when Builders Risk coverage ends.

Builders’ risk is different because it doesn’t always have a perfect expiration date, as it’s supposed to end when the construction is completed. It’s meant to cover a building’s worth based on the percentage of the completed project. As such, the insurance policy increases in value as time goes on.

Due to the unique factors presented above, there are a few ways that the effective date of Builders Risk insurance becomes invalid.

What Invalidates Builders Risk Insurance?

You’ll want to avoid these costly builders risk mistakes and be aware of these events that can invalidate a policy. Sometimes coverage begins and ends before the project’s completion. There are four primary causes of this event, including:

Take Over by Purchaser or Property Owner:

During construction, the general contractor will usually be responsible for the construction project’s insurance. However, the insurance becomes invalid if the owner takes over from the contractor carrying the policy that protects the building under construction. It could also be that the project was sold to another owner.

The owner could be the bank, original property owner, or purchaser. Irrespective of the scenario, and the stage of construction, the existing policy becomes invalid, and a new type of policy must be purchased.

The project will remain incomplete

An insurance provider won’t risk insuring an abandoned project due to its higher risk of vandalization in the form of graffiti, fire, or break-ins. If the property owner or the construction company walks away from a site without intending to finish the construction, then the Builders’ Risk coverage stops immediately after that’s established. It will no longer cover the site.

The site owner can purchase a separate and more expensive insurance policy if they still wish for the abandoned site to be insured.

The property is in use

Builder’s risk coverage stops if a covered property is being used for its intended purpose while it’s still under construction. An example is completing a part of a residential project and having people move in while construction is still ongoing on other parts.

At this point, Builders Risk insurance will have to be changed to something like property insurance. It’s cheaper and covers what is actively happening on the site. Additional insurance can be purchased to cover the construction also happening on site.

Change in Organization’s insurable interest

Insurable interest refers to the people with a financial interest or other involvement with the construction project. It could be an investor, owner, or funding financial institution (bank). If any of these parties changes while construction is ongoing, your insurance company will have to draft a new policy with the updated insurable interests.

That invalidates the old insurance policy, even when the contractors are yet to complete the project.

How much does a builder’s risk insurance cost?

Insurance premiums vary with insurance companies. Most insurers offer between 1-5% of the total project value minus the land cost. It also depends on whether your insurance company bases its calculations on the actual cash value of your building or the replacement value. Factors that affect insurance costs are the project’s value, location, coverage limits, number of employees, project timeline, etc.

Factors to Consider Before Buying a Policy

- An experienced insurance agent will help you get the best out of your policy. Given that many insurance companies and coverage are available, an agent or broker can help you select a suitable Builder’s Risk insurance coverage for your construction project. And provide you with quotes from several insurers.

- Assess all your project exposures on-site, off-site, and in transit, then select the appropriate coverage. You can opt for broad coverage, which includes all property types at all locations. Or narrow coverage for specific properties and losses.

- Know when your coverage begins and the events that will trigger its end.

- Find out what your policy doesn’t cover by asking your insurance provider to explain the exclusions.

Final Words

You must always review your policy to ensure proper coverage before paying the required premium. Because policy coverage also varies among companies. Seek guidance from your insurance agent to get insurers that offer flexible coverage options and allow coverage extensions if needed. Contact Builders Risk today to get your builder’s insurance needs perfectly covered.

Related posts