Also known as Course of Construction, a Builder’s Risk policy provides you with unique property insurance coverage. The policy not only covers the building under construction but the contractor’s property and equipment during the construction process.

It offers protection to anyone with a financial interest in an ongoing construction project, and best of all, you can get a policy for as little as 1% of the construction costs.

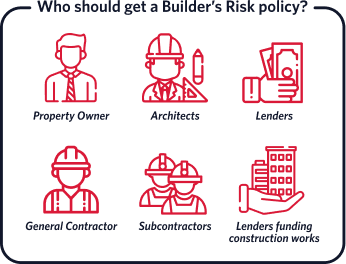

Who should get a Builder’s Risk policy?

Persons requiring Builder’s Risk insurance are:

- The property owner.

- Architects.

- Lenders.

- General contractor.

- Subcontractors.

- Lenders funding construction works.

So, even if you are not the contractor, you should get Builder’s Risk insurance for the project.

If you’re a homeowner planning on remodeling or building a new home, your homeowners coverage will not protect your home during the course of construction.

What Construction Phases does Builder’s Risk insurance policy Cover?

What Construction Phases does Builder’s Risk insurance policy Cover?

- Ground-up new construction.

- Remodeling.

- Installation.

You’re better off covering both the structure and installation, whether you’re putting up a new build or renovating. By doing so, you are providing coverage for damage to your tools, be they stored on-site, or in transit to the job site.

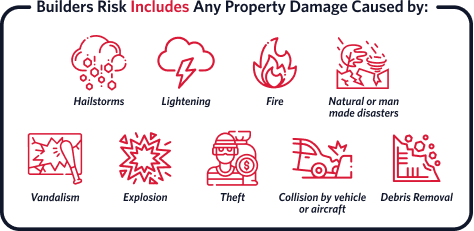

What Sort of damage are you compensated for with your policy?

Builders Risk Includes any property damage caused by:

- Wind and Hail.

- Lightening Strikes.

- Fire.

- Natural or man made disasters.

- Vandalism.

- Explosion.

- Theft.

- Collision by vehicle or aircraft.

- Removal of debris after property damage caused by any of the above factors.

You can extend your coverage to include construction firms, on-site scaffolding, and temporary structures.

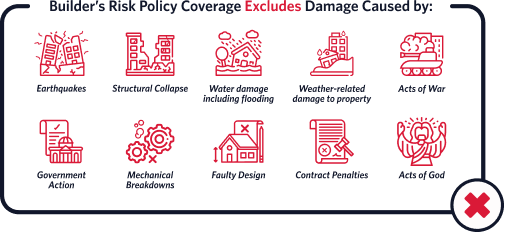

What is Excluded on The Policy?

Builder’s Risk policy coverage excludes damage caused by:

- Earthquakes.

- Structural Collapse.

- Water damage including flooding

- Weather-related damage to property left unprotected in the open

- Acts of War

- Government Action

- Mechanical Breakdowns

- Faulty design, planning, materials, or workmanship

- Contract Penalties

- Acts of God

Note: A Builder’s Risk policy does not cover damage resulting from defective design, shoddy workmanship, or use of inferior materials. You would require Professional Liability insurance to cover these risks.

What is the Price Tag on Builder’s Risk insurance?

A Builder’s Risk policy offers tailor-made coverage to project owners, so the cost will correspond to how much protection you require. The project’s budget, type of project, construction materials, type of coverage, and the policy’s exclusions will significantly influence insurance costs.

- The Project’s Budget.

- Type of Project.

- Construction Materials.

- Type of Coverage.

- Policy’s Exclusions (will significantly influence insurance costs.)

Typically, premiums will range from 1% to 4% of the anticipated cost of construction. For example, risk coverage for a construction project worth $250,000 will carry a premium of between $2,500 to $10,000. If the construction project is likely to lead to financial inconveniences, you should opt for a policy that offers soft costs coverage.

The coverage provided by this policy makes up for the loss of sales revenue, rental income, real estate taxes, and higher interest loans when renovating a building.

Can you extend a Builder’s Risk Policy?

Since risk insurance is a fully earned policy, coverage its assessed pro-rata to let you pick one that suits your project requirements. The policy is available in terms of 3,6 or 12 months.

A fully earned premium means you’re not entitled to a refund if you complete the project ahead of time. For instance, if you purchase an annual policy and complete the project in eight months, the insurer won’t refund any money.You don’t have to incur additional expenses to obtain new coverage if a contractor doesn’t deliver a project on time.

When it comes to construction projects, builder’s risk insurance is one of the most important pieces of the puzzle that often goes overlooked. Be sure to avoid these common builders risk mistakes before finalizing your policy.

Buy Builder’s Risk insurance from the experts

Purchasing a comprehensive Builder’s Risk insurance ensures the construction work flows and sets the stage for speedy delivery. For your own protection, call Builder’s Risk (855) 597-1921.

Buy Builder’s Risk insurance from the experts. Purchasing a comprehensive Builder’s Risk insurance ensures the construction work flows and sets the stage for speedy delivery. For your own protection call an expert or get an instant free quote!